Reading List

The Hot Crazy Matrix explains why investors get tech deals wrong from The Next Web RSS feed.

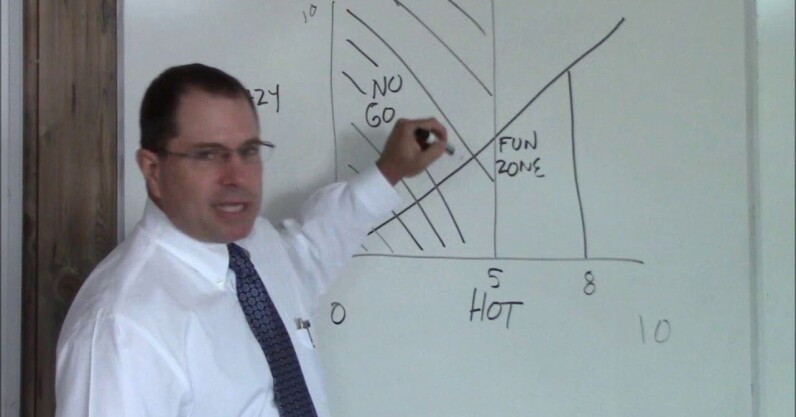

The Hot Crazy Matrix explains why investors get tech deals wrong

Private equity deals hit an all-time high in 2021, peaking at a total value of more than $1tn, with an average deal size exceeding $1bn for the first time. Founders were media darlings, valuations soared, and investors raced to get a piece of the action. By 2023, many of those same companies — such as Klarna and Stripe — had lost billions in value. Klarna’s valuation plummeted by 85% from its 2021 peak of $45.6bn to $6.7bn in 2022. Stripe also fell dramatically, from $95bn in 2021 to $50bn in 2023. Fast forward to today, and even more tech companies…

This story continues at The Next Web